Medical billing is a critical aspect of running a healthcare practice efficiently and effectively.

As a healthcare provider, you want to ensure that your billing processes are accurate, compliant, and optimized for revenue generation.

Many practices opt to outsource their medical billing to professional companies to alleviate the burden and ensure that billing and coding are handled expertly.

However, selecting the right medical billing company can be a pivotal decision for your practice.

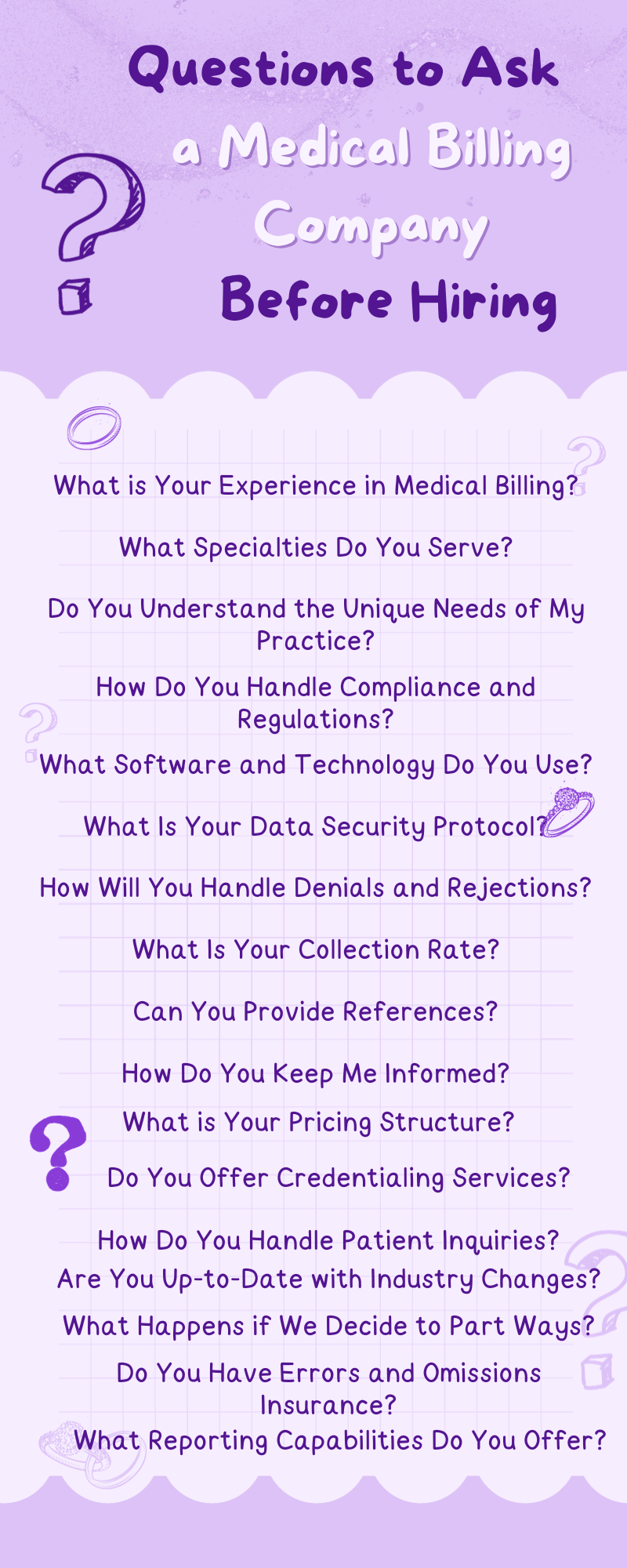

To make an informed choice, it’s essential to ask the following key questions before hiring a medical billing company:

20 Questions To Ask a Medical Billing Company Before Hiring Them

1. What is Your Experience in Medical Billing?

Begin by understanding the experience and track record of the medical billing company. Inquire about how long they have been in the industry and the range of healthcare practices they have served. An established track record often indicates a more reliable and experienced partner.

2. What Specialties Do You Serve?

Not all medical billing companies are well-versed in every medical specialty. It’s crucial to ensure that the billing company has experience working with healthcare practices in your specific field. A deep understanding of your specialty can streamline the billing process and lead to more accurate results.

3. Do You Understand the Unique Needs of My Practice?

Every medical practice has unique requirements. Ensure that the billing company understands the specific needs and nuances of your practice, including any particular challenges you might face.

4. How Do You Handle Compliance and Regulations?

Compliance with healthcare regulations, especially HIPAA (Health Insurance Portability and Accountability Act), is of paramount importance. Inquire about their processes and safeguards to ensure compliance with these regulations. They should have a thorough understanding of privacy and data security.

5. What Software and Technology Do You Use?

Technology plays a pivotal role in medical billing. Ask about the billing software and technology the company employs. It should be up-to-date, secure, and capable of handling the demands of modern healthcare billing.

6. What Is Your Data Security Protocol?

Patient data security is a top priority. Discuss the company’s data security protocols, including encryption, access controls, and disaster recovery plans. Ensure that patient information is protected at all times.

7. How Will You Handle Denials and Rejections?

Claims may be denied or rejected for various reasons. Ask about the company’s approach to handling these situations and their strategies for resolving such issues. A proactive approach to claim denials is vital for maximizing revenue.

8. What Is Your Collection Rate?

The primary goal of medical billing is revenue generation. Request information about their collection rate to understand how successful they are in ensuring timely payments from insurance companies and patients.

9. Can You Provide References?

Seek references from other healthcare practices that have utilized their services. Speaking to these references can provide valuable insights into the company’s performance, reliability, and the satisfaction of their clients.

10. How Do You Keep Me Informed?

Communication is key to a successful partnership. Inquire about their communication process, including reporting and regular updates on the status of claims and the financial health of your practice.

11. What is Your Pricing Structure?

Billing companies often have different fee structures. Discuss their pricing in detail, including any additional costs, such as setup fees or extra charges for specific services. Understanding the financial implications is essential.

12. Do You Offer Credentialing Services?

If your practice requires credentialing with insurance companies, ask if they provide credentialing services. This can save you time and effort in getting on insurance panels.

13. Can You Handle Electronic Health Records (EHR) Integration?

Many healthcare practices use Electronic Health Records (EHR) systems. Ensure that the medical billing company can seamlessly integrate with your existing technology, reducing workflow disruptions.

14. What Is Your Turnaround Time for Claims?

Efficiency is vital in medical billing. Get information about their average turnaround time for submitting and processing claims. Timely submission can lead to quicker reimbursements.

15. How Do You Handle Patient Inquiries?

Patient inquiries about billing issues are common. Ask about their procedures for handling patient inquiries and resolving billing-related questions or concerns.

16. Are You Up-to-Date with Industry Changes?

The healthcare industry is constantly evolving, including billing and coding regulations. Inquire about the company’s commitment to staying current with these changes to ensure that your practice remains compliant.

17. What Happens if We Decide to Part Ways?

Understand the process and terms for terminating the billing services if needed. A clear exit strategy can prevent complications in the future.

18. Do You Have Errors and Omissions Insurance?

Billing errors can occur, and they may have financial consequences. Verify if the company carries errors and omissions insurance to protect against billing errors and their potential impact.

19. How Do You Address Denied Claims?

Denied claims can be a source of lost revenue. Discuss their strategies for appealing and re-submitting denied claims to maximize reimbursement for your practice.

20. What Reporting Capabilities Do You Offer?

Transparent reporting and analytics are essential for understanding your practice’s financial performance. Ask about the types of reports and analytics they can provide to help you track and manage your revenue cycle effectively.

Conclusion

By asking these questions, you can assess the capabilities, expertise, and compatibility of a medical billing company and make an informed decision about whether they are the right fit for your healthcare practice. Remember that a partnership with a medical billing company is a crucial one, and selecting the right one can significantly impact the financial health and efficiency of your practice.