Welcome to our deep dive into the intricate world of Account Receivable Management (ARM). After spending years in the trenches of this field, I’m excited to share my battle-tested strategies and insights to help you conquer the top challenges in ARM.

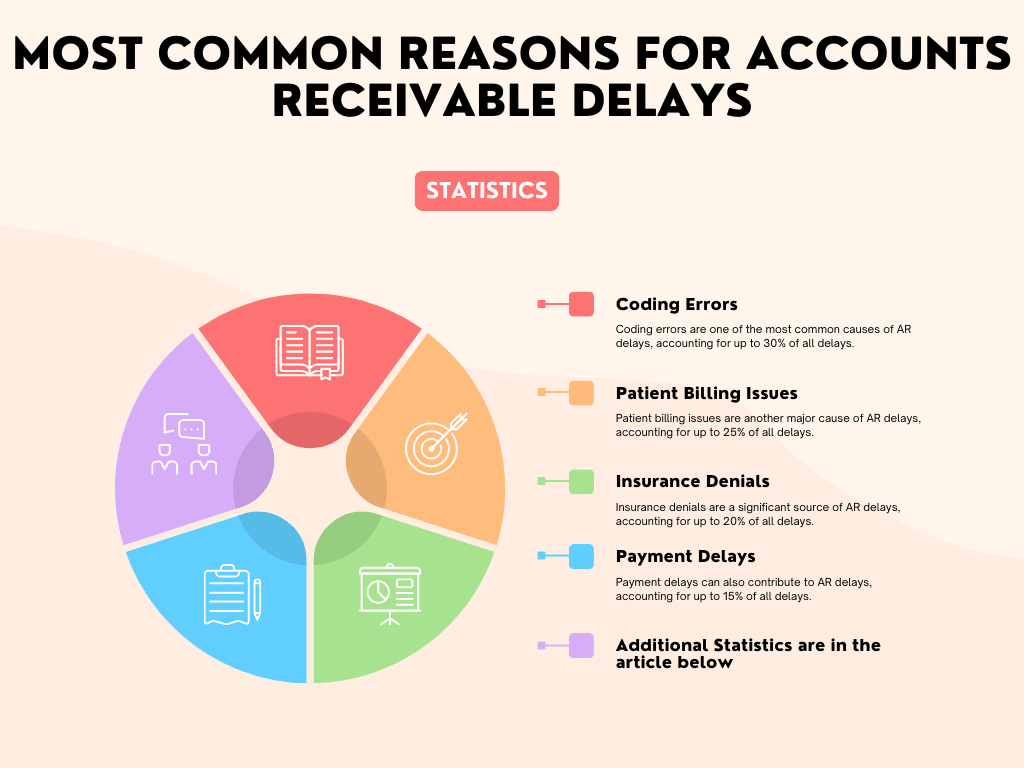

Statistics on the most common reasons for Accounts Receivable (AR) delays

Coding Errors: Coding errors are one of the most common causes of AR delays, accounting for up to 30% of all delays. These errors can occur at any stage of the billing process, from data entry to coding assignment. They can result in claims being denied, delayed, or underpaid.

Patient Billing Issues: Patient billing issues are another major cause of AR delays, accounting for up to 25% of all delays. These issues can include incorrect patient information, missing or incomplete documentation, and disputes over charges.

Insurance Denials: Insurance denials are a significant source of AR delays, accounting for up to 20% of all delays. These denials can occur for a variety of reasons, such as coding errors, policy exclusions, and pre-existing conditions.

Payment Delays: Payment delays can also contribute to AR delays, accounting for up to 15% of all delays. These delays can be caused by a variety of factors, such as financial hardship, disputes over invoices, and slow payment processing by insurance companies.

Additional Statistics:

- The average DSO (Days Sales Outstanding) for businesses in the United States is 45 days.

- AR delays can cost businesses an average of 5% of their annual revenue.

- Businesses can improve their AR collections by up to 10% by implementing effective AR management practices.

Preventing AR Delays:

There are a number of things that businesses can do to prevent AR delays, including:

- Implementing clear and concise billing policies and procedures.

- Providing accurate and up-to-date patient information.

- Using proper coding practices.

- Submitting claims promptly and accurately.

- Following up on outstanding invoices promptly.

- Having a dispute resolution process in place.

Primary Challenges in Account Receivable Management

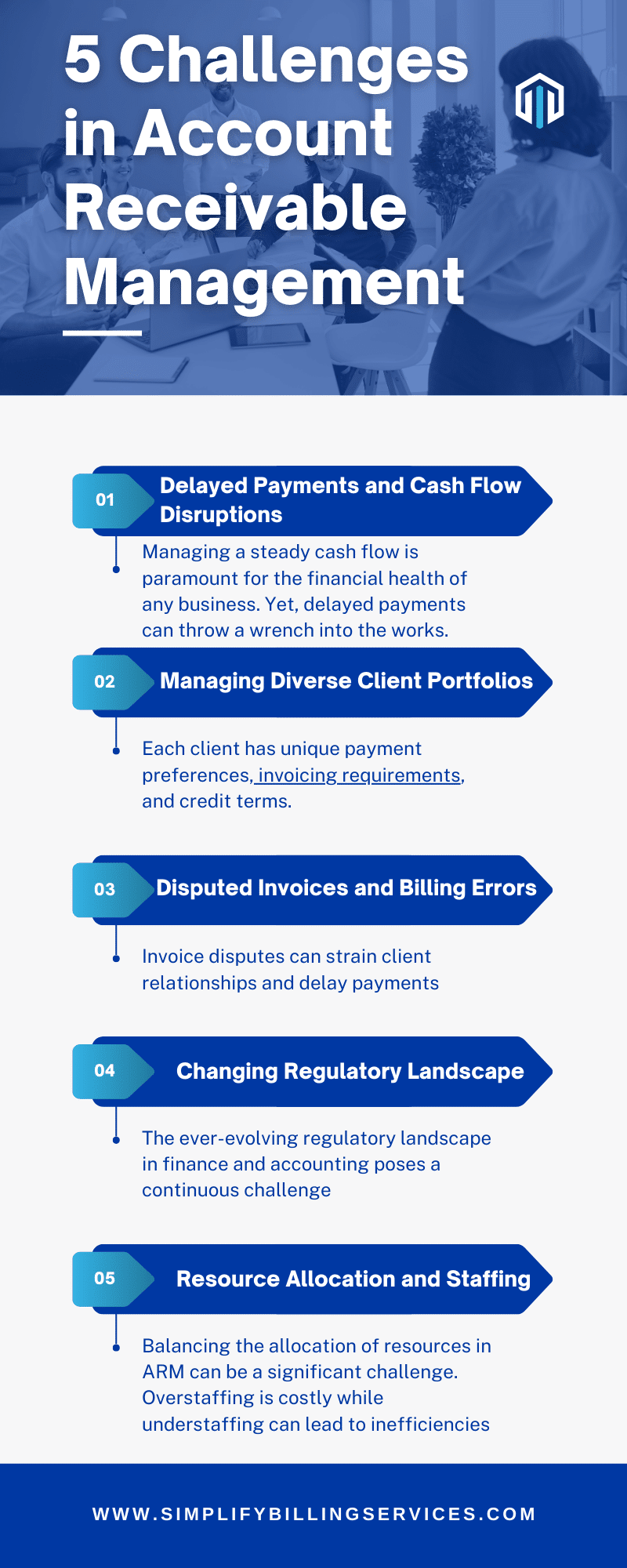

Challenge 1. Delayed Payments and Cash Flow Disruptions

Managing a steady cash flow is paramount for the financial health of any business. Yet, delayed payments can throw a wrench into the works. Here’s how to tackle this challenge:

Solution:

- Clear Payment Terms: Make sure your payment terms are crystal clear in contracts and invoices. Highlight penalties for late payments.

- Leverage Technology: Invest in advanced accounting software to automate invoicing and payment reminders, expediting the payment process.

- Effective Communication: Keep lines of communication open with clients, discussing potential payment issues in advance to find mutually beneficial solutions.

Challenge 2. Managing Diverse Client Portfolios

Each client has unique payment preferences, invoicing requirements, and credit terms. Managing this diversity efficiently is key:

Solution:

- Segmentation: Categorize clients based on payment behavior and needs, creating tailored approaches for each segment.

- Customized Invoicing: Adapt your invoicing methods to align with client preferences, whether electronic or traditional.

- Data Analytics: Leverage data analytics to gain insights into client payment patterns using data analytics to anticipate issues and customize your approach.

Challenge 3. Disputed Invoices and Billing Errors

Invoice disputes can strain client relationships and delay payments. Efficient resolution is crucial:

Solution:

- Detailed Documentation: Maintain meticulous records of all transactions, contracts, and communication as evidence in case of disputes.

- Dispute Resolution Protocols: Develop clear protocols for addressing disputes and ensure your team handles them professionally and promptly.

- Billing Audits: Regularly audit billing processes to identify and rectify errors proactively, improving overall accuracy.

Challenge 4. Changing Regulatory Landscape

The ever-evolving regulatory landscape in finance and accounting poses a continuous challenge:

Solution:

- Continuous Education: Invest in ongoing training for your ARM team to stay informed about regulatory updates and avoid non-compliance issues.

- Compliance Tools: Utilize compliance management software to automate checks and reduce the risk of errors.

- Legal Expertise: Establish a network of legal experts who can provide guidance on complex regulatory matters.

Challenge 5. Resource Allocation and Staffing

Balancing the allocation of resources in ARM can be a significant challenge. Overstaffing is costly while understaffing can lead to inefficiencies:

Solution:

- Workforce Optimization: Regularly assess your ARM team’s workload and performance. Adjust staffing levels and roles for optimal efficiency.

- Outsourcing: Consider outsourcing certain aspects of ARM, such as collections, to specialized agencies. This can help you focus your in-house resources on strategic tasks.

- Invest in Training: Enhance the skills and capabilities of your ARM team through training and development programs. A well-trained team can accomplish more with fewer resources.

Frequently Asked Questions (FAQs) – Top Challenges in Account Receivable Management and How to Overcome Them

What are the common causes of delayed payments?

Delayed payments can be caused by various factors, including client financial constraints, disputes over services or products, and internal processing delays. Clear communication and proactive measures can help mitigate these issues.

How can I effectively resolve invoice disputes with clients?

Resolving disputes requires clear documentation, well-defined protocols, and a professional approach. Ensure you have a process in place to address issues promptly and amicably.

Are there specific software solutions for Account Receivable Management?

Yes, there are many software options available that can streamline ARM processes, from invoicing and payment tracking to reporting and analytics. Explore various solutions to find one that suits your needs.

What are the benefits of outsourcing collections in ARM?

Outsourcing collections can save time and resources, as specialized agencies often have the expertise and tools to recover outstanding debts more efficiently. It also allows your in-house team to focus on other strategic tasks.

How often should I update my compliance processes?

Regular updates are crucial to staying compliant with changing regulations. Aim to review and update your compliance processes at least annually, or whenever there are significant regulatory changes.

Conclusion

In the dynamic world of Account Receivable Management, adaptability, clear communication, and continuous improvement are the keys to success. As you embark on your ARM journey, remember to stay vigilant, stay connected with your clients, and stay informed about evolving regulations. By implementing the strategies outlined in this guide, you’re on the path to not only overcoming ARM challenges but also achieving financial stability and growth. Now, take the first step and put these insights into action!