Effective accounts receivable management is essential for maintaining a steady cash flow and ensuring a stable business operation.

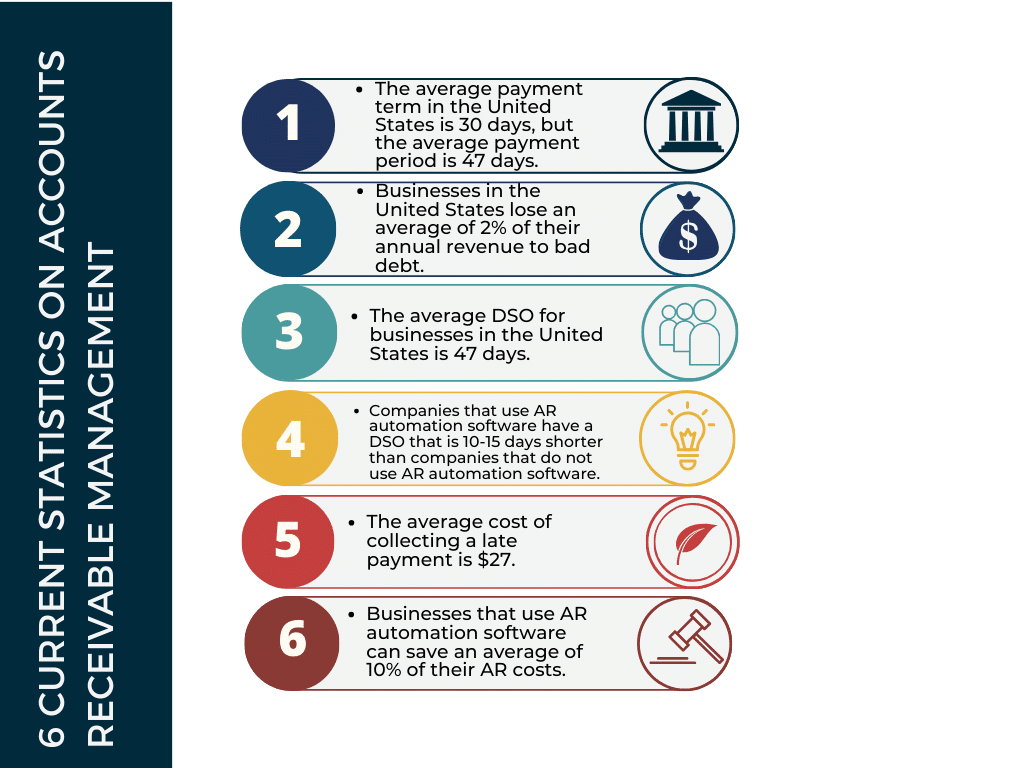

7 Current Statistics on Accounts Receivable Management

1. Late payments are a common problem.

93% of businesses experience late payments from customers. This can disrupt cash flow and make it difficult to meet financial obligations. (source: Atradius).

2. The average payment period is longer than the average payment term.

The average payment term in the United States is 30 days, but the average payment period is 47 days. This means that businesses are waiting an average of 17 days longer than they should for payment. (source: Atradius)

3. Businesses lose money to bad debt.

Businesses in the United States lose an average of 2% of their annual revenue to bad debt. This can be a significant financial loss, especially for small businesses. (source: Atradius)

4. The average DSO is too high.

The average DSO for businesses in the United States is 47 days. This means that businesses are taking too long to collect payments from their customers. (source: Credit Suisse)

5. AR automation software can help businesses improve their DSO.

Companies that use AR automation software have a DSO that is 10-15 days shorter than companies that do not use AR automation software. (source: Sage)

6. Collecting a late payment is expensive.

The average cost of collecting a late payment is $27. This can add up to a significant expense for businesses that experience a lot of late payments. (source: ARC)

7. AR automation software can help businesses save money on AR costs.

Businesses that use AR automation software can save an average of 10% of their AR costs. (source: Sage)

In this comprehensive guide, we will explore what accounts receivable management is, why it matters, the impacts and benefits it offers, the process involved, common challenges, performance measurement, best practices, the role of AR management software, and various strategies to optimize your accounts receivable process.

What is Accounts Receivable Management?

Accounts receivable management refers to the systematic approach taken by businesses to oversee their outstanding customer invoices and ensure timely payment. It involves a series of processes and strategies designed to maximize cash flow and minimize bad debt, ultimately contributing to the financial stability and growth of the organization.

Why Is Accounts Receivable Important and Why Does it Matter?

Did you know? Accounts receivable is crucial for several reasons. Let’s discuss in 3 simple examples.

- Firstly, it represents the money owed to a business by its customers, which, if managed efficiently, can significantly enhance liquidity.

- Secondly, it is a key indicator of a company’s financial health and creditworthiness. Investors and creditors often evaluate an organization’s AR performance when making decisions.

- Lastly, effective AR management helps maintain strong customer relationships by ensuring that billing and collection processes are fair and consistent.

Detailed Strategies to Improve Accounts Receivable Management:

Accurate Documentation:

- Accurate and thorough documentation of patient information, medical services provided, and treatment plans is the foundation of proper billing. Ensure that your healthcare providers maintain detailed records.

Verify Insurance Information:

- Verify patients’ insurance coverage before appointments or procedures. Outdated or incorrect insurance information can lead to delayed or denied claims.

Transparent Billing Practices:

- Transparency in billing is vital. Patients should easily understand the breakdown of charges. It’s also essential to clearly explain any additional costs or co-pays.

Timely Billing:

- Submit claims to insurance companies promptly. Delays can result in bottlenecks in the revenue cycle. Establish a streamlined billing process with clear timelines.

Utilize Electronic Health Records (EHR):

- Invest in a robust EHR system that integrates with your billing software. EHR systems not only enhance clinical documentation but also improve billing accuracy and efficiency.

Staff Training and Development:

- Regularly train and update your billing and administrative staff on coding, billing regulations, and insurance policies. The healthcare landscape is continually evolving, and knowledgeable staff can adapt more effectively.

Denial Management:

- Develop a comprehensive denial management process. Analyze common reasons for claim denials and implement solutions to minimize them. Promptly resubmit corrected claims.

Follow-Up on Unpaid Claims:

- Implement a systematic follow-up process for unpaid claims. This may involve sending reminders, making phone calls, or utilizing automated software to track and escalate outstanding balances.

Financial Counseling for Patients:

- Offer financial counseling services to patients who may have difficulty paying their medical bills. Provide information on payment plans, financial assistance programs, and available resources.

Regular Financial Audits:

- Conduct routine financial audits to identify trends, assess the effectiveness of your accounts receivable management, and make necessary process improvements.

Consider Outsourcing Billing Services:

- If managing billing in-house becomes overwhelming, consider outsourcing to specialized medical billing services. They have the expertise and resources to maximize revenue collection.

Patient Education:

- Educate patients about their insurance benefits, co-pays, deductibles, and potential out-of-pocket expenses. Informed patients are more likely to fulfill their financial obligations promptly.

Stay Informed About Regulations:

- Stay up-to-date with healthcare billing and reimbursement regulations at the federal, state, and insurance company levels. Compliance is crucial to avoid legal complications.

Technology Integration:

- Leverage technology for payment processing, including online payment portals and automated reminders. These tools can expedite payments and reduce administrative burden.

Monitor Key Performance Indicators (KPIs):

- Regularly track KPIs such as Days Sales Outstanding (DSO), accounts receivable aging reports, and claim acceptance rates. These metrics provide insights into the financial health of your practice.

The Impacts and Benefits of AR Management

Effective accounts receivable management can profoundly impact a company’s financial well-being. Some of the key benefits and impacts include:

1. Improved Cash Flow

By reducing the time it takes to collect payments, businesses can maintain a healthy cash flow, enabling them to cover operational expenses, invest in growth, and seize new opportunities.

2. Reduced Bad Debt

Proactive management helps promptly identify and address delinquent accounts, reducing the risk of bad debt write-offs and preserving profitability.

3. Enhanced Creditworthiness

A strong AR management system can improve a company’s creditworthiness, making securing financing or negotiating favorable terms with suppliers easier.

4. Efficient Resource Allocation

Organizations can allocate resources more efficiently by streamlining processes, leading to cost savings and improved profitability.

5. Better Decision-Making

Accurate and up-to-date AR data provides valuable insights to inform strategic decisions and optimize financial planning.

How to Optimize Your Accounts Receivable Process

To optimize your accounts receivable process, consider the following steps:

1. Establish Clear Credit Policies

Define clear credit terms and policies for your customers to ensure that expectations are set from the beginning of the business relationship.

2. Timely Invoicing

Send out invoices promptly and ensure they are accurate, complete, and easy to understand. This encourages timely payment.

3. Effective Collections

Implement a structured collections process that includes friendly reminders, follow-ups, and escalation procedures for overdue accounts.

4. Credit Risk Assessment

Regularly assess the creditworthiness of your customers and adjust credit limits accordingly to minimize risk.

5. Automation

Invest in AR management software to automate routine tasks, track invoices, and provide real-time visibility into your receivables.

Factors That Complicate Accounts Receivable Management

Despite its importance, managing accounts receivable can be a complex task. Several factors can complicate the process, including:

1. Diverse Customer Base

Dealing with a diverse customer base with varying payment habits and credit profiles can make it challenging to standardize AR procedures.

2. Economic Conditions

Economic fluctuations can impact customers’ ability to pay, leading to uncertainty in cash flow forecasting.

3. Inaccurate Data

Only complete or accurate customer information and invoices can lead to delays and disputes in payment.

4. Manual Processes

Reliance on manual processes can result in errors, inefficiencies, and increased collection times.

The Accounts Receivable Management Process

The AR management process typically involves several stages, including:

1. Credit Approval

Evaluating the creditworthiness of customers and determining appropriate credit limits.

2. Invoicing

Generating and delivering invoices to customers for goods or services rendered.

3. Payment Receipt

Recording payments received and reconciling them with outstanding invoices.

4. Collections

Contacting customers with overdue accounts, sending reminders, and escalating collections efforts if necessary.

5. Reporting and Analysis

Analyzing AR data to assess performance, identify trends, and make informed decisions.

What Are Some Common Challenges of Accounts Receivable Management?

Accounts receivable management comes with its fair share of challenges, including:

1. Slow Payments

Delayed payments from customers can disrupt cash flow and impact financial stability.

2. Invoice Disputes

Disputes over invoice accuracy or quality of goods/services can prolong the collection process.

3. Customer Defaults

Some customers may default on their payments, leading to bad debt write-offs.

4. High Administrative Costs

Manual processes can be labor-intensive and costly, eating into profits.

5. Data Security

Protecting sensitive customer information and financial data is critical.

How to Measure Performance of AR Management

To gauge the effectiveness of your AR management, consider these key performance indicators (KPIs):

1. Days Sales Outstanding (DSO)

DSO measures the average number of days it takes to collect customer payments. A lower DSO indicates faster collections.

2. Aging of Accounts Receivable

Categorizing outstanding invoices by age helps identify overdue accounts and prioritize collections efforts.

3. Bad Debt Ratio

The ratio of bad debt write-offs to total sales reflects the effectiveness of credit risk assessment and collections.

4. Collection Efficiency Index

This KPI assesses the efficiency of collection efforts by comparing the amount collected to the total outstanding.

5. Customer Satisfaction

Customer feedback and satisfaction surveys can provide insights into the customer experience during payment.

What Are Accounts Receivable Management Best Practices?

Implementing best practices can enhance AR management:

1. Regular Reconciliation

Frequently reconcile payments with invoices to identify discrepancies and resolve them promptly.

2. Customer Communication

Maintain open and transparent communication with customers about payment expectations and any issues that may arise.

3. Streamline Processes

Automate routine tasks to reduce errors and speed up collections.

4. Offer Payment Options

Provide flexible payment options to make it easier for customers to settle their accounts.

5. Continuous Training

Keep your AR team well-trained in the latest techniques and technologies to stay competitive.

What About AR Management Software?

AR management software can be a game-changer for businesses. It offers features such as:

1. Automated Invoicing

Generate and send invoices automatically, reducing manual work.

2. Payment Processing

Allow customers to make payments electronically, improving convenience.

3. Reporting and Analytics

Access real-time data and insights to make informed decisions.

4. Collections Workflow

Automate collections processes, including reminders and escalations.

How to Choose Accounts Receivable Automation Software

When selecting AR automation software, consider factors like:

1. Compatibility

Ensure the software integrates seamlessly with your existing systems.

2. Scalability

Choose a solution that can grow with your business.

3. User-Friendliness

Opt for software that is easy for your team to learn and use.

4. Cost

Balance the cost of the software with the potential benefits it offers.

Key Areas of Accounts Receivable Management

Key areas to focus on for effective AR management include:

1. Credit Management

Carefully assess and manage customer credit risks.

2. Invoicing

Streamline the invoicing process to reduce errors and accelerate payments.

3. Collections

Implement efficient collection strategies to minimize overdue accounts.

4. Reporting and Analysis

Leverage data and analytics to improve your AR processes continuously.

Methods of Speeding up Cash Collection from Accounts Receivable

To accelerate cash collection, consider these methods:

1. Early Payment Discounts

Offer discounts to encourage early payment by customers.

2. Payment Plans

Allow customers to spread payments over time to ease their financial burden.

3. Automated Reminders

Use automation to send payment reminders to customers before due dates.

4. Credit Card Payments

Accept credit card payments for faster transactions.

How Do I Prioritize Collecting Receivables?

Prioritize receivables by focusing on:

1. Age of Receivables

Start with the oldest outstanding invoices, which are more likely to become delinquent.

2. Payment History

Consider a customer’s payment history and prioritize those with a track record of late payments.

3. Outstanding Balances

Address accounts with the highest outstanding balances first to recover significant amounts.

4. Communication

Engage in clear and persistent communication with customers to resolve outstanding issues.

Best Practices & Policies for Accounts Receivable Management

Establishing best practices and policies can guide your AR management efforts:

1. Credit Policy

Set clear credit limits and terms and regularly review and adjust them.

2. Billing Policy

Standardize invoicing procedures to minimize errors and disputes.

3. Collections Policy

Create a collections policy that outlines procedures for contacting overdue accounts and escalation steps.

4. Data Security Policy

Implement robust data security measures to protect customer information.

Ways to Improve Accounts Receivable Management

Continually improving AR management involves:

1. Customer Feedback

Solicit customer feedback to identify areas where you can enhance the payment experience.

2. Benchmarking

Compare your AR performance with industry benchmarks to identify areas for improvement.

3. Training

Invest in ongoing training for your AR team to update them on industry best practices.

4. Technology Adoption

Explore emerging technologies to stay competitive and streamline processes.

Common Mistakes That Affect Accounts Receivable Management

Avoid these common mistakes in AR management:

1. Neglecting Credit Checks

Failing to conduct thorough credit checks can lead to risky customer relationships.

2. Poor Invoicing

Only accurate or clear invoices can cause payment delays.

3. Inconsistent Collections

Inconsistencies in collections efforts can confuse customers and hinder resolution.

4. Lack of Communication

Failure to communicate payment expectations can lead to misunderstandings.

Personal Experience: Navigating the Challenges of Accounts Receivable

To illustrate the real-world challenges and rewards of accounts receivable management, let’s delve into the journey of Sarah, an experienced finance professional with over a decade of expertise overseeing AR for a mid-sized manufacturing company.

Sarah’s story offers valuable insights into the complexities and nuances of managing accounts receivable.

Sarah’s Journey Through Accounts Receivable

Sarah, a seasoned finance professional, has traversed a path laden with experiences that provide a candid glimpse into the accounts receivable world. Her career spans over a decade and has been marked by both triumphs and tribulations in financial management.

One of the unforgettable chapters in Sarah’s career unfolded during economic turbulence when customers’ payment habits grew increasingly erratic due to market instability. Cash flow became a pressing concern, demanding swift adaptation from her and her team.

A standout moment was when Sarah encountered loyal, long-term customer-facing financial difficulties in settling their outstanding invoices. Instead of adopting an adversarial approach, she initiated a compassionate dialogue with the customer. Collaboratively, they devised a revised payment plan tailored to the customer’s financial constraints. This ensured a consistent flow of payments and nurtured a stronger, more resilient customer relationship.

Sarah’s journey also led her to confront the challenge of invoice disputes, a common occurrence in accounts receivable. She recounts an instance when a customer contested an invoice, alleging receipt of damaged goods. This situation underscored the importance of meticulous record-keeping. Armed with comprehensive documentation of the shipment and quality checks, Sarah’s team resolved the dispute amicably, reinforcing the principle that clear records are essential in managing such conflicts.

Throughout her career, Sarah has witnessed firsthand the transformative impact of technology on accounts receivable management. The implementation of AR management software proved to be a watershed moment for her organization. It automated routine tasks, significantly reduced errors, and provided real-time insights into receivables. This technological advancement bolstered operational efficiency and allowed her team to focus on strategic aspects of AR management.

One of the most gratifying aspects of Sarah’s journey has been witnessing the direct correlation between effective accounts receivable management and a company’s financial well-being. As her team successfully reduced the day’s sales outstanding (DSO) and mitigated bad debt write-offs, the organization reaped the rewards in the form of a healthier bottom line, fostering opportunities for growth and expansion.

Sarah’s journey underscores the dynamic nature of accounts receivable management. It underscores the importance of adaptable strategies, adept communication, and innovative problem-solving. In her view, effective AR management encompasses a delicate balance between financial acumen, interpersonal skills, and technological prowess.

In summary, Sarah’s narrative serves as a testament to the multifaceted role of accounts receivable professionals in shaping a company’s financial stability and growth. Her experiences illuminate the arduous yet rewarding path that characterizes AR management.

Conclusion

Effective accounts receivable management is vital for any business seeking financial stability and growth. By understanding the importance of AR, implementing best practices, leveraging technology, and continuously improving processes, organizations can unlock the full potential of their accounts receivable, ensuring a healthier bottom line and stronger customer relationships. Simplify Billing Services is your trusted partner for comprehensive healthcare solutions. Explore how we can help you:

Accounts Receivable Management Services: Enhance your revenue flow by clicking here.

Revenue Cycle Management Services: Optimize your financial performance with us here.

Credentialing and Contracting Solutions: Ensure your practice is properly credentialed with payers. Learn more here.

Eligibility and Benefits Verification Solutions: Simplify your verification process by visiting us here.

Medical Billing and Coding Services: Streamline your billing and coding processes. Discover how we can assist you here.

Take the next step towards optimizing your healthcare operations by exploring these services today.