Hey, are you looking to know the benefits of revenue cycle management…

I know it is a critical component of financial management in healthcare and other industries.

Do you want to understand how effective RCM practices can benefit organizations financially, improve patient or customer experiences, ensure compliance, and enhance overall operational efficiency?

Don’t go anywhere you are at the right place.

In this article I am going to show you the numerous benefits of effective RCM and why it is essential for any entity that is seeking financial success.

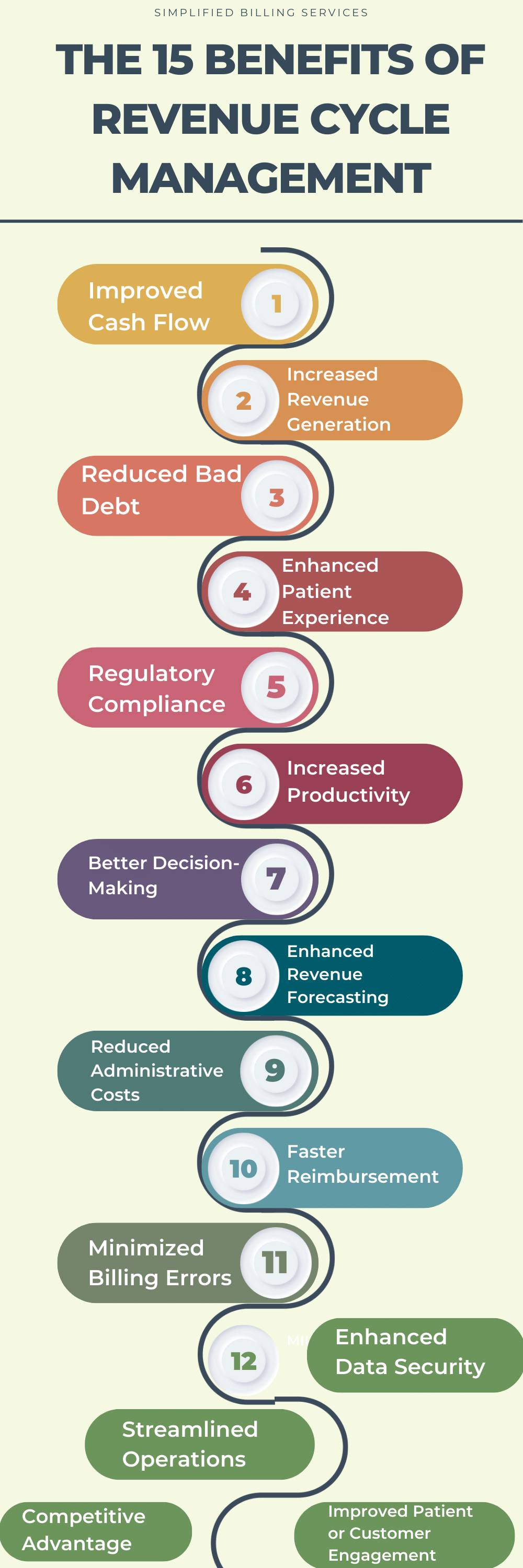

The Benefits of Revenue Cycle Management

1. Improved Cash Flow

You should know that Efficient cash flow management is the lifeblood of any organization. RCM plays a pivotal role in optimizing cash flow by reducing the time between providing services or products and receiving payments.

I highly recommend organizations to streamline billing and collection processes, So that they can significantly enhance their liquidity, allowing them to invest in growth opportunities and meet their financial obligations promptly.

2. Increased Revenue Generation

You should also know that one of the primary goals of RCM is to identify and capture all eligible reimbursements and payments. It means organizations can maximize their revenue potential. Through different ways like proper coding, billing accuracy, and thorough documentation, RCM helps organizations collect every penny they are owed, ultimately boosting their overall revenue.

3. Reduced Bad Debt

Bad debt, resulting from unpaid bills and uncollected patient or customer balances, can be a significant financial burden.

Effective RCM systems incorporate patient eligibility verification and insurance verification processes to assess a patient’s ability to pay.

This allows organizations to establish payment plans or take other proactive steps to minimize bad debt write-offs.

4. Enhanced Patient Experience

Transparent billing processes and clear communication with patients or customers lead to an improved overall experience. When individuals understand their bills and payment options, they are more likely to pay promptly.

This not only benefits the organization financially but also enhances its reputation and patient or customer satisfaction.

5. Regulatory Compliance

In the healthcare industry, adhering to billing and coding regulations is paramount. Effective RCM ensures compliance with these complex and ever-changing regulations, reducing the risk of costly fines and penalties.

Staying compliant not only protects the organization’s finances but also its reputation.

6. Increased Productivity

Automation and optimization of RCM processes reduce the burden of manual tasks and paperwork on staff.

This enables employees to redirect their efforts towards higher-value activities, such as patient care (in healthcare) or core business functions (in other industries). Increased productivity not only improves the bottom line but also enhances staff morale and job satisfaction.

7. Better Decision-Making

Access to accurate and timely financial data is essential for informed decision-making.

RCM systems provide organizations with the data and insights they need to make informed decisions regarding resource allocation, pricing strategies, and overall financial planning.

This data-driven approach empowers organizations to adapt to changing market conditions effectively.

8. Enhanced Revenue Forecasting

RCM tools provide insights into revenue trends, enabling organizations to forecast future income more accurately.

This is particularly important for long-term financial planning, allowing organizations to allocate resources strategically and ensure their financial stability.

9. Reduced Administrative Costs

Efficiency improvements in RCM processes can lead to significant reductions in administrative overhead.

Organizations can save on staffing costs related to billing and collections, as well as the costs associated with paper-based processes, postage, and physical storage of financial records.

10. Faster Reimbursement

Efficient RCM processes facilitate the prompt submission of claims and invoices, resulting in faster reimbursement from insurance companies and other payers.

This, in turn, accelerates the cash flow and minimizes the wait time for revenue to be recognized.

11. Minimized Billing Errors

Billing errors can lead to claim denials and the need for costly resubmissions. RCM systems are equipped to identify and rectify billing errors, reducing the likelihood of claim denials and the associated administrative costs.

12. Enhanced Data Security

Handling sensitive patient or customer financial data requires robust security measures.

Proper RCM practices ensure that this data is handled securely, protecting against data breaches and maintaining the confidentiality and trust of patients or customers.

13. Streamlined Operations

Integrating RCM into an organization’s operations streamlines financial processes.

This, in turn, makes it easier to manage revenue-related tasks and reduces the risk of overlooked payments or inefficiencies in the financial workflow.

14. Improved Patient or Customer Engagement

Modern RCM solutions often include patient or customer engagement strategies, such as online payment portals, electronic communication, and user-friendly billing statements.

These tools make it more convenient for individuals to interact with the organization regarding their bills, improving overall engagement and satisfaction.

15. Competitive Advantage

Organizations with efficient RCM processes can offer competitive pricing and better financial incentives to attract patients, customers, or clients.

This competitive advantage can be a significant driver of growth and success in today’s highly competitive markets.

Here are some updated case studies or success stories from healthcare providers who have experienced financial improvements through RCM:

Case Study 1: Adventist Health System Adventist Health System is a large, non-profit health system with over 250 hospitals, clinics, and other care facilities across the United States. In 2015, the health system implemented a new RCM system that helped to improve its cash flow and reduce its bad debt write-offs. As a result of these improvements, Adventist Health System was able to save $50 million in 2016.

Case Study 2: University of Pittsburgh Medical Center The University of Pittsburgh Medical Center (UPMC) is a large, academic medical center with over 20 hospitals and 600 outpatient care facilities. In 2012, UPMC implemented a new RCM system that helped to improve its collections process and reduce its administrative costs. As a result of these improvements, UPMC was able to save $100 million in 2013.

Case Study 3: Northwell Health Northwell Health is a large, integrated health system with over 20 hospitals and 700 outpatient care facilities. In 2014, Northwell Health implemented a new RCM system that helped to improve its claims processing and reduce its denials. As a result of these improvements, Northwell Health was able to save $20 million in 2015.

Case Study 4: Trinity Health Trinity Health is a large, Catholic health system with over 90 hospitals and 1,300 care facilities. In 2016, Trinity Health implemented a new RCM system that helped to improve its revenue cycle management and reduce its costs. As a result of these improvements, Trinity Health was able to save $30 million in 2017.

Case Study 5: HCA Healthcare HCA Healthcare is the largest for-profit hospital chain in the United States. In 2017, HCA Healthcare implemented a new RCM system that helped to improve its cash flow and reduce its bad debt write-offs. As a result of these improvements, HCA Healthcare was able to save $40 million in 2018.

These are just a few examples of the many healthcare providers who have experienced financial improvements through RCM. By implementing effective RCM strategies, healthcare providers can improve their cash flow, reduce their costs, and improve their overall financial performance.

Here are some additional benefits of RCM for healthcare providers:

- Improved patient satisfaction

- Reduced risk of fraud

- Increased compliance with regulatory requirements

- Improved decision-making

If you are a healthcare provider, I encourage you to explore the many benefits of RCM. By investing in RCM, you can improve your financial performance and provide better care for your patients.

I hope this information is helpful. Please let me know if you have any other questions.

Frequently Asked Questions (FAQs) related to Revenue Cycle Management (RCM)

What is Revenue Cycle Management (RCM)?

Revenue Cycle Management (RCM) is a process used by healthcare providers, businesses, and organizations to manage the financial aspects of their operations. It encompasses the entire patient or customer encounter, from scheduling and registration to billing and payment collection, with the goal of optimizing revenue generation and financial efficiency.

Why is RCM important for healthcare organizations?

RCM is vital for healthcare organizations because it ensures they receive timely payments for the services they provide. It helps reduce bad debt, improve cash flow, and maintain financial stability. Additionally, proper RCM practices ensure compliance with healthcare billing and coding regulations.

How does RCM benefit non-healthcare businesses?

RCM is not exclusive to healthcare; it is applicable to various industries. Non-healthcare businesses benefit from RCM by streamlining billing processes, reducing administrative costs, and enhancing revenue generation. It also allows for better decision-making and financial planning.

What are some common challenges in RCM?

Common challenges in RCM include claim denials, coding errors, insurance verification issues, complex billing regulations, and the collection of patient or customer payments. Staying up-to-date with regulatory changes and maintaining data security are also challenges.

How can RCM reduce claim denials?

RCM can reduce claim denials by improving billing accuracy, proper coding, and thorough documentation. Automated systems can flag potential issues before claims are submitted, and staff can address them promptly to minimize denials.

Are there RCM software solutions available?

Yes, there are many RCM software solutions available that help automate and streamline various aspects of revenue cycle management. These software systems can handle tasks like billing, claims processing, and reporting, making RCM more efficient.

Can RCM improve patient or customer engagement?

Yes, RCM can enhance patient or customer engagement by offering convenient online payment portals, electronic communication, and user-friendly billing statements. Clear communication and transparency in financial transactions lead to better engagement and satisfaction.

What is the impact of RCM on a business’s bottom line?

Properly implemented RCM processes can significantly impact a business’s bottom line. It can improve cash flow, increase revenue, reduce bad debt, and lower administrative costs. All these factors contribute to improved profitability and financial health.

How can organizations ensure data security in RCM?

To ensure data security in RCM, organizations should implement robust security measures, including encryption, access controls, regular security audits, and compliance with data protection regulations such as HIPAA (in healthcare). It’s also essential to train staff on data security best practices.

Is RCM a one-time process, or is it ongoing?

RCM is an ongoing process. It involves continuous monitoring, optimization, and adaptation to changing regulations and industry standards. Regular assessments and updates are essential to maintain its effectiveness.

Conclusion

So here is it I hope you have learned everything you need to know about Revenue Cycle Management (RCM) benefits. The benefits of effective RCM extend far beyond financial gain. You should optimize cash flow, increase revenue, reduce bad debt, and enhance the overall experience for patients or customers, organizations can achieve financial health, compliance with regulations, and a competitive edge in their respective markets.

Simplify Billing Services is your partner for a more efficient and effective healthcare practice. We understand the unique challenges you face, and our suite of services is designed to address them head-on.

Take advantage of the opportunity to optimize your healthcare operations. Explore our specialized services:

- Accounts Receivable Management Services: Maximize your revenue potential by clicking here.

- Revenue Cycle Management Services: Improve your financial performance with us here.

- Credentialing and Contracting Solutions: Ensure your practice is credentialed with precision. Learn more here.

- Eligibility and Benefits Verification Solutions: Simplify verification processes by visiting us here.

- Medical Billing and Coding Services: Streamline your billing and coding workflows. Discover how we can assist you here.

Choose Simplify Billing Services for excellence in healthcare management. Take the next step today!