Dear fellow healthcare professionals, practice administrators, and anyone involved in managing the financial aspects of a healthcare facility,

Today, I want to share with you my personal journey and experiences in effectively reviewing the revenue cycle process of a healthcare practice.

Managing the financial health of a medical facility is no small feat, and it’s a topic that’s rarely discussed in detail.

Through the years, I’ve gathered insights, learned from my mistakes, and discovered strategies that have significantly improved our revenue cycle. In this article, I’ll take you through the essential steps and best practices to ensure your practice thrives financially.

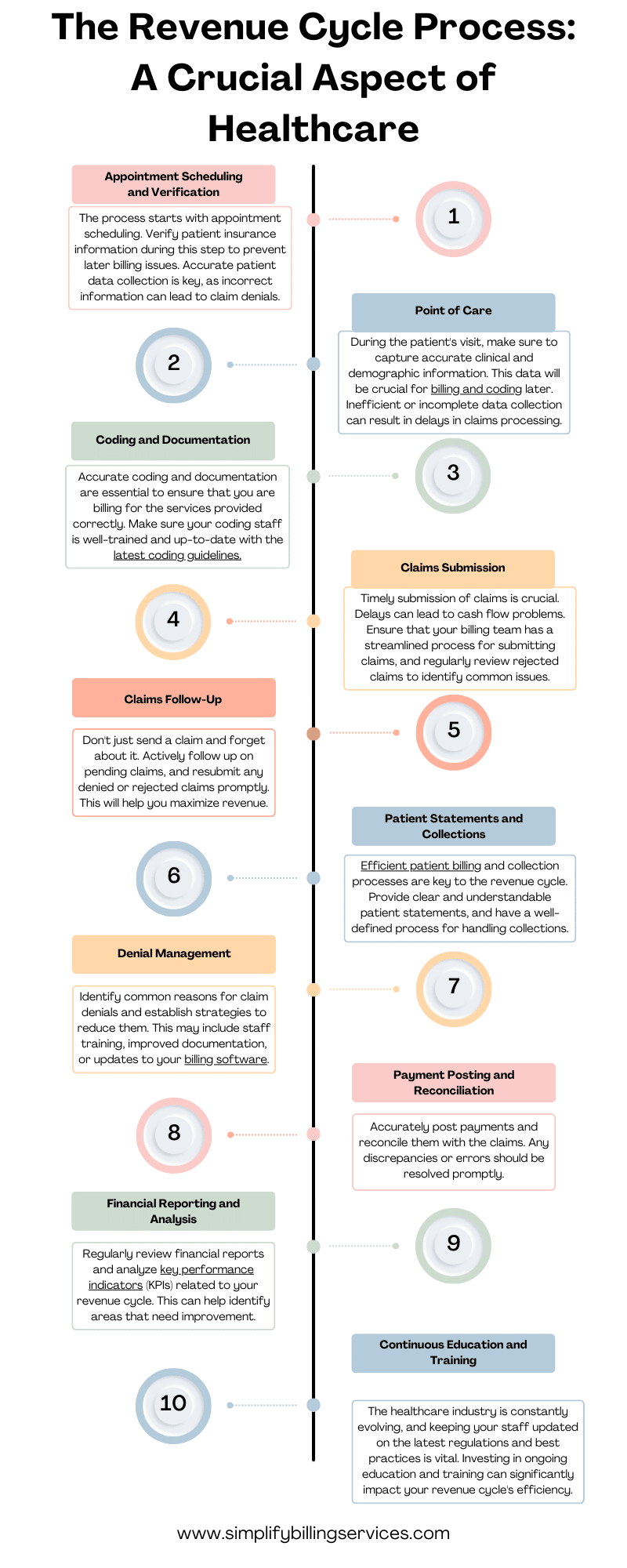

The Revenue Cycle Process: A Crucial Aspect of Healthcare

The revenue cycle process is the backbone of any healthcare practice. It encompasses the entire patient journey, from the moment an appointment is scheduled to the final reimbursement received.

Understanding and optimizing this process is essential for a practice’s sustainability and growth.

Appointment Scheduling and Verification

The process starts with appointment scheduling. Verify patient insurance information during this step to prevent later billing issues. Accurate patient data collection is key, as incorrect information can lead to claim denials.

Point of Care

During the patient’s visit, make sure to capture accurate clinical and demographic information. This data will be crucial for billing and coding later. Inefficient or incomplete data collection can result in delays in claims processing.

Coding and Documentation

Accurate coding and documentation are essential to ensure that you are billing for the services provided correctly. Make sure your coding staff is well-trained and up-to-date with the latest coding guidelines.

Claims Submission

Timely submission of claims is crucial. Delays can lead to cash flow problems. Ensure that your billing team has a streamlined process for submitting claims, and regularly review rejected claims to identify common issues.

Claims Follow-Up

Don’t just send a claim and forget about it. Actively follow up on pending claims, and resubmit any denied or rejected claims promptly. This will help you maximize revenue.

Patient Statements and Collections

Efficient patient billing and collection processes are key to the revenue cycle. Provide clear and understandable patient statements, and have a well-defined process for handling collections.

Denial Management

Identify common reasons for claim denials and establish strategies to reduce them. This may include staff training, improved documentation, or updates to your billing software.

Payment Posting and Reconciliation

Accurately post payments and reconcile them with the claims. Any discrepancies or errors should be resolved promptly.

Financial Reporting and Analysis

Regularly review financial reports and analyze key performance indicators (KPIs) related to your revenue cycle. This can help identify areas that need improvement.

Continuous Education and Training

The healthcare industry is constantly evolving, and keeping your staff updated on the latest regulations and best practices is vital. Investing in ongoing education and training can significantly impact your revenue cycle’s efficiency.

Challenges and Pitfalls

Throughout my journey, I’ve encountered various challenges and pitfalls that can hinder the revenue cycle process. These include:

- Regulatory Changes: The ever-changing healthcare landscape means you must stay up-to-date with new regulations, codes, and compliance requirements.

- Technology Issues: Outdated or inefficient billing and EHR systems can lead to errors and delays in the revenue cycle.

- Human Error: Mistakes in data entry, coding, and billing can have a significant impact on revenue.

- Inadequate Training: Insufficient training for your staff can result in mistakes and inefficiencies.

- Denials and Rejections: Understanding why claims are denied and addressing these issues is critical.

- Patient Responsibility: With the rise of high-deductible health plans, collecting from patients is becoming more challenging.

- Competition: Increased competition in the healthcare industry necessitates a proactive approach to revenue cycle management.

Success Stories

As you review your revenue cycle process, consider these success stories and strategies I’ve witnessed:

- Automation: Invest in automation to streamline repetitive tasks and reduce the risk of human error.

- Outsourcing: Consider outsourcing revenue cycle management to experts who can navigate the complexities of billing and coding.

- Data Analytics: Leverage data analytics to identify trends and areas for improvement.

- Patient Engagement: Engage patients in understanding their financial responsibilities and making payments.

- Revenue Integrity Programs: Implement a revenue integrity program to ensure that you’re billing correctly and capturing all revenue opportunities.

In Conclusion

Effectively reviewing and managing the revenue cycle process is a continuous journey. It requires dedication, regular assessment, and adaptation to the ever-changing healthcare landscape.

The financial health of your practice depends on a well-organized and efficient revenue cycle.

I hope my experiences and insights have shed light on this critical aspect of healthcare administration. Whether you are a seasoned healthcare professional or just starting your career, I encourage you to take a closer look at your revenue cycle and consider the strategies mentioned here.

Your practice’s financial well-being and, ultimately, your ability to provide quality patient care, depend on it.

Thank you for joining me on this journey through the world of revenue cycle management. I wish you all the best in optimizing your practice’s revenue cycle and ensuring its long-term success.